As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. One difference is the supplies account; the figure on paper doesnot match the value of the supplies inventory still available.Another difference was interest earned from his bank account. We at Deskera offer an intuitive, easy-to-use accounting software you can access from any device with an internet connection. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

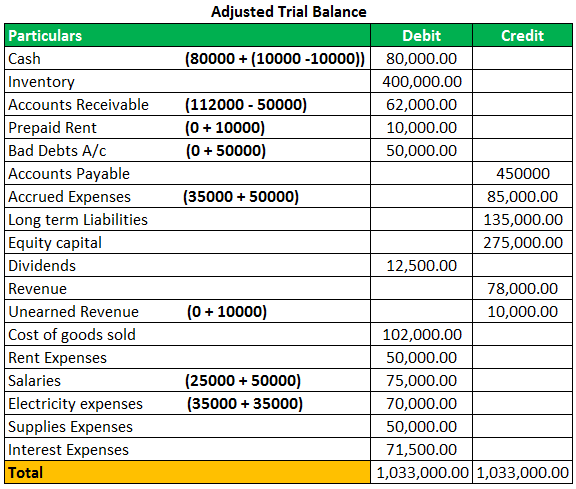

Trial Balance

The revenue recognition principle requires businesses to recognize revenue when it is earned, regardless of when payment is received. Adjustment entries are necessary to ensure that revenue is recognized in the correct period, even if payment has not been received. The matching principle is a fundamental accounting principle that requires expenses to be matched with the revenues they generated. Adjustment entries ensure that all expenses and revenues are recorded in the correct period, even if they were not initially recorded. Amortization is the allocation of the cost of an intangible asset over its useful life. To record amortization, an accountant would debit an expense account and credit an accumulated amortization account.

What are Adjusting Journal Entries (AJE)?

If you don’t make adjusting entries, your income and expenses won’t match up correctly. At the end of the accounting period, you may not be reporting expenses that happen in the previous month. For example, say you need to hire a freelancer to help you at the end of February.

- Previously unrecorded service revenue can arise when a companyprovides a service but did not yet bill the client for the work.This means the customer has also not yet paid for services.

- First, during February, when you produce the bags and invoice the client, you record the anticipated income.

- That’s why most companies use cloud accounting software to streamline their adjusting entries and other financial transactions.

Bookkeeping

In contrast to accruals, deferrals are cash prepayments that are made prior to the actual consumption or sale of goods and services. These entries can also involve the use of supplies accounts to record the use of inventory or other supplies. Estimating too high or too low can also lead to incorrect financial statements.

Did we continue to follow the rules of adjusting entries inthese two examples? In this case, Unearned Fee Revenue increases (credit) and Cashincreases (debit) for $48,000. 10 steps to effective conflict resolution Depreciation is the process of assigning a cost of an asset, such as a building or piece of equipment over the economic or serviceable life of that asset.

Mistake: Lag in Recording Transactions

The revenue is recognized through an accrued revenue account and a receivable account. When the cash is received at a later time, an adjusting journal entry is made to record the cash receipt for the receivable account. Income statement accounts that may need to be adjusted include interest expense, insurance expense, depreciation expense, and revenue. The entries are made in accordance with the matching principle to match expenses to the related revenue in the same accounting period.

These entries are made at the end of an accounting period to adjust accounts and reflect any changes that have occurred during the period. To record an accrual, an accountant would debit an expense account and credit a liability account. Adjustment entries are an important part of the accounting period and the accounting cycle. The accounting period is the period of time for which financial statements are prepared, usually one year. The accounting cycle is the process of recording, classifying, and summarizing financial transactions for a given accounting period. Each type of adjustment entry serves a specific purpose and is designed to ensure that financial statements are accurate and complete.

Even though you’re paid now, you need to make sure the revenue is recorded in the month you perform the service and actually incur the prepaid expenses. Generally, adjusting journal entries are made for accruals and deferrals, as well as estimates. Sometimes, they are also used to correct accounting mistakes or adjust the estimates that were previously made. Overall, adjustment entries play a crucial role in ensuring the accuracy and reliability of financial statements. Companies that take the time to properly record and adjust their accounts will be better equipped to make informed business decisions and meet their financial obligations.

Comment (0)